For crypto-asset service providers (CASPs), understanding and navigating MiCA, particularly Article 4, is essential for legal compliance and business success.

Understanding MiCA and its impact on Crypto-Asset Service Providers (CASPs)

What is MiCA? An overview of the markets in crypto-assets regulation

MiCA is a regulatory framework proposed by the European Commission to oversee crypto-assets and their service providers within the EU. Its primary goals are to:

Provide legal clarity: establish a unified set of rules for crypto-assets not covered by existing financial services regulations.

Enhance consumer protection: safeguard investors and consumers from risks associated with crypto-assets.

Ensure market integrity: Prevent market abuse and promote fair competition.

Support Innovation: Encourage the development of crypto-asset markets and the integration of new technologies in financial services.

By addressing these goals, MiCA aims to foster a secure and innovative environment for the growth of crypto-assets in Europe.

The Significance of Article 4 in authorization requirements

Article 4 of MiCA is a pivotal section that outlines the authorization requirements for CASPs. It mandates that any entity looking to provide crypto-asset services in the EU must obtain prior authorization from a competent national authority.

Legal Operation: without authorization under Article 4, CASPs cannot legally operate within the EU.

Standardized Criteria: establishes uniform criteria for authorization, promoting consistency across member states.

Market Confidence: authorized CASPs are perceived as more trustworthy, enhancing their reputation among consumers and investors.

Understanding Article 4 is crucial for CASPs to navigate the regulatory landscape and ensure compliance.

Key authorization requirements under Article 4

Financial and capital obligations for service providers

Under Article 4, CASPs must meet specific financial thresholds to demonstrate their stability and ability to safeguard client assets.

Minimum capital requirements: CASPs must hold a minimum amount of initial capital, which varies depending on the services provided. For instance:

€125,000 for offering custody and administration services.

€50,000 for exchange services or trading platforms.

Ongoing capital adequacy: Maintain sufficient own funds to cover operational expenses and potential losses, ensuring solvency and resilience.

These financial obligations are designed to protect clients and promote confidence in the crypto market.

Organizational and governance standards to meet

MiCA emphasizes strong governance structures and organizational frameworks for CASPs.

Qualified management: Board members and senior management must possess the necessary qualifications, experience, and integrity.

Clear organizational structure: Implement clear lines of responsibility and reporting, facilitating effective oversight and decision-making.

Policies and procedures: Establish comprehensive internal policies addressing compliance, risk management, and operational processes.

Conflict of interest management: Identify, prevent, and manage any conflicts of interest that may arise.

Adhering to these standards ensures CASPs operate ethically and efficiently.

Operational compliance and risk management practices

Effective operational controls and risk management are critical components of the authorization requirements.

Risk assessment framework: Develop systems to identify, monitor, and mitigate risks related to business activities.

Security measures: Implement robust IT systems and cybersecurity protocols to protect client data and assets.

Compliance function: Establish an independent compliance function responsible for ensuring adherence to regulatory obligations.

Reporting and record-keeping: Maintain accurate records and report regularly to regulatory authorities.

By prioritizing operational compliance, CASPs can minimize risks and maintain market integrity.

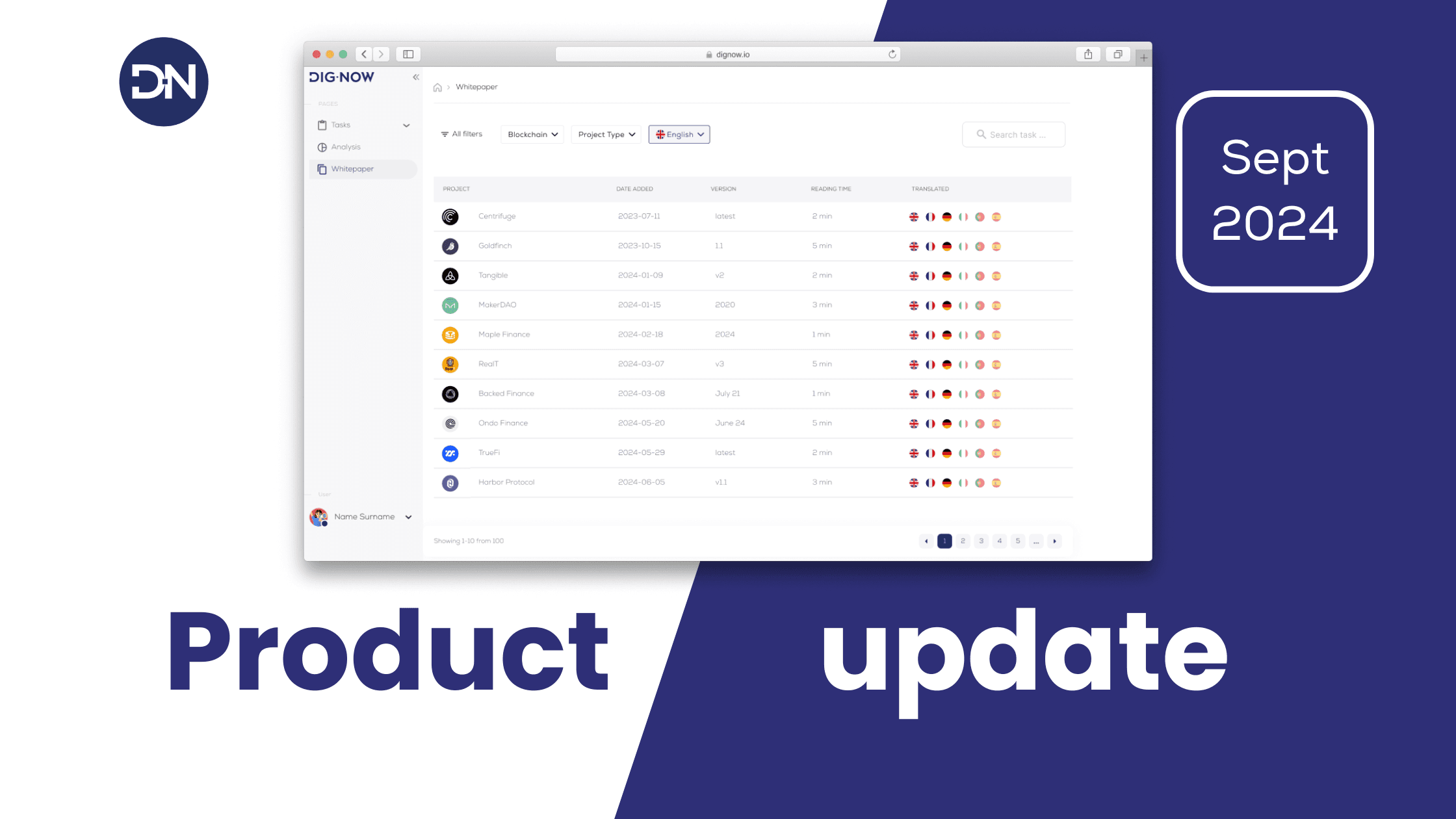

DigNow is pioneering AI-driven compliance for digital assets

Our platform is the first to offer scaled due diligence, leveraging cutting-edge technology to simplify and automate the process. We provide automated whitepaper analysis to ensure compliance with relevant regulatory frameworks, real-time alerts for ongoing monitoring, and advanced liquidity tracking. Our unique hybrid approach combines AI with community-driven data validation and flagging, providing unparalleled accuracy. And we're just getting started – expect more innovative features to support your crypto and digital asset investment strategies.

Conclusion

Key Takeaways on MiCA Authorization Requirements

Mandatory authorization: CASPs must obtain authorization under Article 4 to operate legally in the EU.

Holistic compliance approach: Meeting financial, organizational, and operational requirements is essential.

Relevant link: https://finance.ec.europa.eu/digital-finance_en

Understanding MiCA and its impact on Crypto-Asset Service Providers (CASPs)

What is MiCA? An overview of the markets in crypto-assets regulation

MiCA is a regulatory framework proposed by the European Commission to oversee crypto-assets and their service providers within the EU. Its primary goals are to:

Provide legal clarity: establish a unified set of rules for crypto-assets not covered by existing financial services regulations.

Enhance consumer protection: safeguard investors and consumers from risks associated with crypto-assets.

Ensure market integrity: Prevent market abuse and promote fair competition.

Support Innovation: Encourage the development of crypto-asset markets and the integration of new technologies in financial services.

By addressing these goals, MiCA aims to foster a secure and innovative environment for the growth of crypto-assets in Europe.

The Significance of Article 4 in authorization requirements

Article 4 of MiCA is a pivotal section that outlines the authorization requirements for CASPs. It mandates that any entity looking to provide crypto-asset services in the EU must obtain prior authorization from a competent national authority.

Legal Operation: without authorization under Article 4, CASPs cannot legally operate within the EU.

Standardized Criteria: establishes uniform criteria for authorization, promoting consistency across member states.

Market Confidence: authorized CASPs are perceived as more trustworthy, enhancing their reputation among consumers and investors.

Understanding Article 4 is crucial for CASPs to navigate the regulatory landscape and ensure compliance.

Key authorization requirements under Article 4

Financial and capital obligations for service providers

Under Article 4, CASPs must meet specific financial thresholds to demonstrate their stability and ability to safeguard client assets.

Minimum capital requirements: CASPs must hold a minimum amount of initial capital, which varies depending on the services provided. For instance:

€125,000 for offering custody and administration services.

€50,000 for exchange services or trading platforms.

Ongoing capital adequacy: Maintain sufficient own funds to cover operational expenses and potential losses, ensuring solvency and resilience.

These financial obligations are designed to protect clients and promote confidence in the crypto market.

Organizational and governance standards to meet

MiCA emphasizes strong governance structures and organizational frameworks for CASPs.

Qualified management: Board members and senior management must possess the necessary qualifications, experience, and integrity.

Clear organizational structure: Implement clear lines of responsibility and reporting, facilitating effective oversight and decision-making.

Policies and procedures: Establish comprehensive internal policies addressing compliance, risk management, and operational processes.

Conflict of interest management: Identify, prevent, and manage any conflicts of interest that may arise.

Adhering to these standards ensures CASPs operate ethically and efficiently.

Operational compliance and risk management practices

Effective operational controls and risk management are critical components of the authorization requirements.

Risk assessment framework: Develop systems to identify, monitor, and mitigate risks related to business activities.

Security measures: Implement robust IT systems and cybersecurity protocols to protect client data and assets.

Compliance function: Establish an independent compliance function responsible for ensuring adherence to regulatory obligations.

Reporting and record-keeping: Maintain accurate records and report regularly to regulatory authorities.

By prioritizing operational compliance, CASPs can minimize risks and maintain market integrity.

DigNow is pioneering AI-driven compliance for digital assets

Our platform is the first to offer scaled due diligence, leveraging cutting-edge technology to simplify and automate the process. We provide automated whitepaper analysis to ensure compliance with relevant regulatory frameworks, real-time alerts for ongoing monitoring, and advanced liquidity tracking. Our unique hybrid approach combines AI with community-driven data validation and flagging, providing unparalleled accuracy. And we're just getting started – expect more innovative features to support your crypto and digital asset investment strategies.

Conclusion

Key Takeaways on MiCA Authorization Requirements

Mandatory authorization: CASPs must obtain authorization under Article 4 to operate legally in the EU.

Holistic compliance approach: Meeting financial, organizational, and operational requirements is essential.

Relevant link: https://finance.ec.europa.eu/digital-finance_en

Understanding MiCA and its impact on Crypto-Asset Service Providers (CASPs)

What is MiCA? An overview of the markets in crypto-assets regulation

MiCA is a regulatory framework proposed by the European Commission to oversee crypto-assets and their service providers within the EU. Its primary goals are to:

Provide legal clarity: establish a unified set of rules for crypto-assets not covered by existing financial services regulations.

Enhance consumer protection: safeguard investors and consumers from risks associated with crypto-assets.

Ensure market integrity: Prevent market abuse and promote fair competition.

Support Innovation: Encourage the development of crypto-asset markets and the integration of new technologies in financial services.

By addressing these goals, MiCA aims to foster a secure and innovative environment for the growth of crypto-assets in Europe.

The Significance of Article 4 in authorization requirements

Article 4 of MiCA is a pivotal section that outlines the authorization requirements for CASPs. It mandates that any entity looking to provide crypto-asset services in the EU must obtain prior authorization from a competent national authority.

Legal Operation: without authorization under Article 4, CASPs cannot legally operate within the EU.

Standardized Criteria: establishes uniform criteria for authorization, promoting consistency across member states.

Market Confidence: authorized CASPs are perceived as more trustworthy, enhancing their reputation among consumers and investors.

Understanding Article 4 is crucial for CASPs to navigate the regulatory landscape and ensure compliance.

Key authorization requirements under Article 4

Financial and capital obligations for service providers

Under Article 4, CASPs must meet specific financial thresholds to demonstrate their stability and ability to safeguard client assets.

Minimum capital requirements: CASPs must hold a minimum amount of initial capital, which varies depending on the services provided. For instance:

€125,000 for offering custody and administration services.

€50,000 for exchange services or trading platforms.

Ongoing capital adequacy: Maintain sufficient own funds to cover operational expenses and potential losses, ensuring solvency and resilience.

These financial obligations are designed to protect clients and promote confidence in the crypto market.

Organizational and governance standards to meet

MiCA emphasizes strong governance structures and organizational frameworks for CASPs.

Qualified management: Board members and senior management must possess the necessary qualifications, experience, and integrity.

Clear organizational structure: Implement clear lines of responsibility and reporting, facilitating effective oversight and decision-making.

Policies and procedures: Establish comprehensive internal policies addressing compliance, risk management, and operational processes.

Conflict of interest management: Identify, prevent, and manage any conflicts of interest that may arise.

Adhering to these standards ensures CASPs operate ethically and efficiently.

Operational compliance and risk management practices

Effective operational controls and risk management are critical components of the authorization requirements.

Risk assessment framework: Develop systems to identify, monitor, and mitigate risks related to business activities.

Security measures: Implement robust IT systems and cybersecurity protocols to protect client data and assets.

Compliance function: Establish an independent compliance function responsible for ensuring adherence to regulatory obligations.

Reporting and record-keeping: Maintain accurate records and report regularly to regulatory authorities.

By prioritizing operational compliance, CASPs can minimize risks and maintain market integrity.

DigNow is pioneering AI-driven compliance for digital assets

Our platform is the first to offer scaled due diligence, leveraging cutting-edge technology to simplify and automate the process. We provide automated whitepaper analysis to ensure compliance with relevant regulatory frameworks, real-time alerts for ongoing monitoring, and advanced liquidity tracking. Our unique hybrid approach combines AI with community-driven data validation and flagging, providing unparalleled accuracy. And we're just getting started – expect more innovative features to support your crypto and digital asset investment strategies.

Conclusion

Key Takeaways on MiCA Authorization Requirements

Mandatory authorization: CASPs must obtain authorization under Article 4 to operate legally in the EU.

Holistic compliance approach: Meeting financial, organizational, and operational requirements is essential.

Relevant link: https://finance.ec.europa.eu/digital-finance_en

Understanding MiCA and its impact on Crypto-Asset Service Providers (CASPs)

What is MiCA? An overview of the markets in crypto-assets regulation

MiCA is a regulatory framework proposed by the European Commission to oversee crypto-assets and their service providers within the EU. Its primary goals are to:

Provide legal clarity: establish a unified set of rules for crypto-assets not covered by existing financial services regulations.

Enhance consumer protection: safeguard investors and consumers from risks associated with crypto-assets.

Ensure market integrity: Prevent market abuse and promote fair competition.

Support Innovation: Encourage the development of crypto-asset markets and the integration of new technologies in financial services.

By addressing these goals, MiCA aims to foster a secure and innovative environment for the growth of crypto-assets in Europe.

The Significance of Article 4 in authorization requirements

Article 4 of MiCA is a pivotal section that outlines the authorization requirements for CASPs. It mandates that any entity looking to provide crypto-asset services in the EU must obtain prior authorization from a competent national authority.

Legal Operation: without authorization under Article 4, CASPs cannot legally operate within the EU.

Standardized Criteria: establishes uniform criteria for authorization, promoting consistency across member states.

Market Confidence: authorized CASPs are perceived as more trustworthy, enhancing their reputation among consumers and investors.

Understanding Article 4 is crucial for CASPs to navigate the regulatory landscape and ensure compliance.

Key authorization requirements under Article 4

Financial and capital obligations for service providers

Under Article 4, CASPs must meet specific financial thresholds to demonstrate their stability and ability to safeguard client assets.

Minimum capital requirements: CASPs must hold a minimum amount of initial capital, which varies depending on the services provided. For instance:

€125,000 for offering custody and administration services.

€50,000 for exchange services or trading platforms.

Ongoing capital adequacy: Maintain sufficient own funds to cover operational expenses and potential losses, ensuring solvency and resilience.

These financial obligations are designed to protect clients and promote confidence in the crypto market.

Organizational and governance standards to meet

MiCA emphasizes strong governance structures and organizational frameworks for CASPs.

Qualified management: Board members and senior management must possess the necessary qualifications, experience, and integrity.

Clear organizational structure: Implement clear lines of responsibility and reporting, facilitating effective oversight and decision-making.

Policies and procedures: Establish comprehensive internal policies addressing compliance, risk management, and operational processes.

Conflict of interest management: Identify, prevent, and manage any conflicts of interest that may arise.

Adhering to these standards ensures CASPs operate ethically and efficiently.

Operational compliance and risk management practices

Effective operational controls and risk management are critical components of the authorization requirements.

Risk assessment framework: Develop systems to identify, monitor, and mitigate risks related to business activities.

Security measures: Implement robust IT systems and cybersecurity protocols to protect client data and assets.

Compliance function: Establish an independent compliance function responsible for ensuring adherence to regulatory obligations.

Reporting and record-keeping: Maintain accurate records and report regularly to regulatory authorities.

By prioritizing operational compliance, CASPs can minimize risks and maintain market integrity.

DigNow is pioneering AI-driven compliance for digital assets

Our platform is the first to offer scaled due diligence, leveraging cutting-edge technology to simplify and automate the process. We provide automated whitepaper analysis to ensure compliance with relevant regulatory frameworks, real-time alerts for ongoing monitoring, and advanced liquidity tracking. Our unique hybrid approach combines AI with community-driven data validation and flagging, providing unparalleled accuracy. And we're just getting started – expect more innovative features to support your crypto and digital asset investment strategies.

Conclusion

Key Takeaways on MiCA Authorization Requirements

Mandatory authorization: CASPs must obtain authorization under Article 4 to operate legally in the EU.

Holistic compliance approach: Meeting financial, organizational, and operational requirements is essential.

Relevant link: https://finance.ec.europa.eu/digital-finance_en